Development Guide

The OANDA FIX API documents describe the behavior of the current version of the OANDA FIX Server, and indicate how to interact and place trades through this service.

The Financial Information eXchange (“FIX”) protocol is a series of messaging specifications for the electronic communication of financial data, including trade-related messages. It is a globally accepted standard of messaging specifications developed through the collaboration of banks, brokers, exchanges, institutional investors, and information technology providers from around the world.

OANDA fxTrade supports 4.4 version of the FIX protocol. You are urged to download and consult the official FIX specifications and the recommended best practices document at http://www.fixprotocol.org/.

The OANDA FIX API primarily focuses on serving institutional customers who wish to benefit from OANDA’s liquidity and carry their positions in their own account at a prime broker. Customers who require OANDA platform specific features not found in the FIX order model should consider using the REST-based OANDA Open API.

Environment

| Environment | URL |

|---|---|

| fxTrade Practice | fxgame-fix.oanda.com |

| fxTrade | fxtrade-fix.oanda.com |

Connection Requirements

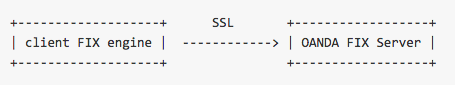

To use the OANDA FIX API:

you must have an API license agreement with OANDA

you need to use your own FIX engine to connect to the OANDA server

- OANDA does not officially recommend or provide any particular FIX engine; any compliant engine should work

- All communications are done over SSL on the internet

- Strong encryption meeting the

HIGH+SHA+AEScipher list is required - If your FIX engine is not natively SSL-capable, alternate SSL tunneling software is required

- Stunnel_ has been used successfully by many customers but the responsibility for configuring and running it lies with the customer

- A sample stunnel configuration file for the fxTrade Practice system is shown below:

## fxTrade Practice (testing) ##

client=yes

verify=0

socket=l:TCP_NODELAY=1

socket=r:TCP_NODELAY=1

[FXFIX]

accept=30008

connect=fxgame-fix.oanda.com:32009

TIMEOUTclose=0

ciphers=HIGH+SHA+AES

OANDA FIX API Connections

Customers are required to use two separate connections to the FIX API, a RATES connection for market data, and an ORDER connection for all order execution.

All connections use the customers login username for the system as the

SenderCompID value. All connections use OANDA as the

TargetCompID value.

A RATES connection is established by including TargetSubID=RATES

in the header. An ORDER connection is established by omitting any

TargetSubID in the header. (Unrecognized TargetSubID values

are currently treated as for the ORDER connection but this behavior is

not guaranteed.)

The OANDA system runs a continuous 24-hour trading session during the trading week. Trading is not available over the weekend (Friday 5pm North America Eastern Time to market open Monday). No daily or weekly sequence number reset is explicitly required, although weekend maintenance periods may take the servers offline and any reconnection requires a sequence number reset.

System Requirements

Accurate clock synchronization is important for both parties to ensure communication is prompt and any latency can be detected. The local clock will need to be accurately synchronized via a properly-configured NTP service using non-pool time servers or another high-accuracy mechanism.

Note some Windows systems do not run a time service with enough accuracy to ensure clock synchronization.

Supported Features

The OANDA FIX API provides streaming market data for requested symbols and order placement on a user’s accounts.

No account status or positions information is currently available through the FIX interface.

Market Data

The OANDA FIX API provides access to OANDA’s real-time streaming prices.

One-time snapshots are supported. For users requiring real-time price updates as they occur, subscriptions must be used instead of rapid repeated polling.

Order Entry

The OANDA FIX API implements a FIX order model to the OANDA trading system.

Supported Order Types

Immediately Executed Order Types

Market Orders

Market orders are orders to buy or sell a particular quantity of a currency pair at the prevailing price at the time the order was received at the OANDA servers.

Fill-or-Kill (FOK) Orders, Immediate-or-Cancel (IOC) Orders

Orders placed FOK are executed immediately if the price and quantity stipulations are met at the time the order is received; if the stipulations are not met, the order is cancelled in full. Orders placed IOC are executed immediately if the price stipulation is met, up to the available quantity for execution, and the remaining quantity is cancelled.

Price-Conditional Order Types

Standard Limit Orders

A standard limit order requests a trade of some quantity of a currency pair, at the requested price or better. If the prevailing market price is already better than the request price at the time the order is received, the order fills immediately. Otherwise, the order waits for execution until the price stipulation is met or the order expires.

Standard limit orders requesting Fill-or-Kill (FOK) or Immediate-or-Cancel (IOC) execution behave as described in the previous section.

Standard Stop Orders

A standard stop order requests a trade of some quantity of a currency pair, at the requested price or worse. If the prevailing market price is already worse than the request price at the time the order is received, the order fills immediately. Otherwise, the order waits for execution until the price stipulation is met or the order expires.

Standard stop orders requesting Fill-or-Kill (FOK) or Immediate-or-Cancel (IOC) execution behave as described in the previous section.

Market-if-Touched Orders

(This order type is called a “limit order” in OANDA’s other APIs and graphical interfaces.)

A market-if-touched order requests a trade of some quantity of a currency pair when the requested price is touched. If the prevailing market price is exactly the request price at the time the order is recieved, the order fills immediately. Otherwise, the order waits for execution until the market price touches/crosses the request price or the order expires.

Market-if-touched orders execute at OANDA-published prices; if a waiting market-if-touched order triggers due to the market price crossing the request price, the fill will occur at the first market price after the request price is crossed.

Market-if-touched orders cannot be requested FOK or IOC.

Market-if-touched orders can only be placed on FIX.4.4 sessions.

Market Depth

The OANDA fxTrade trading system imposes a maximum trade size for individual trades. The maximum trade size is specified in the market data entry size for the largest tier for the side in market data messages.

The maximum trade sizes for the OANDA trading system are the following (although these maximums may not be available at all times due to limited liquidity):

| Pair | Maximum Units |

|---|---|

| XAG/USD | 100000 |

| XAU/USD | 5000 |

| All other tradeable pairs | 10000000 |

(Users are welcome to place multiple trades to trade higher quantities.)

Orders submitted with requested quantity larger than the quantity available for execution are handled differently depending on the order type:

| Order Type | Result | Notes |

|---|---|---|

| FOK orders | order cancelled | Not filled at all |

| IOC orders | order cancelled | Partially filled up to the quantity available |

| all others | order rejected | Order rejected outright |

Mapping of FIX Server Orders to OANDA Transaction-view Tickets

The OANDA FIX Server implements the FIX order model, which is the model typically found in the equities and futures markets. This order model differs from the order model of the underlying OANDA trading system exposed in the GUI, website transaction history, and OANDA OpenAPI.

Understanding the differences between the FIX order model and the OANDA backend transaction ticket order model is critical to understanding how one order representation is described in the other.

In FIX terminology, an order is any request to trade a symbol, whether

immediate or good for some time duration. In the OANDA model, the term

order is used for entry orders, limit orders, or stop orders with some

order lifetime; these orders result in a BuyEntry, BuyLimit, or

BuyStop (and the analogous Sell orders) transaction ticket; the term

trade is any position that results from an immediate buy or sell on

the account (a BuyMarket or SellMarket transaction ticket) or from

the triggering of an OANDA order.

The OANDA transaction ticket stop-loss, take-profit, and trailing-stop annotations are not available in the FIX order model.

Customers who place orders in the OANDA FIX API and view them via the website transaction history will need to know which OANDA transaction tickets correspond to a FIX order. Each Execution Report <8> describing a order result will list OANDA transaction tickets in the Text <58> field.

The Text <58> field will contain a clause of the form

OANDA transaction ID(s): listwhere

listis a comma-separated list of ticket number ranges. For example, tickets 21, 22, 23, 26, and 30 would be displayed as

OANDA transaction ID(s): 21-23,26,30

The way that FIX orders are mapped to transaction tickets is described below:

Transaction Ticket Groups

Multiple OANDA transaction tickets can correspond to a FIX order.

Fills may result in multiple tickets if there is an existing open position in the opposite direction of the current trade; individual transactions ticket would record the closing of the opposite-direction position, with a potential extra ticket recording the excess quantity in the current direction

Example: with an existing position

buy 100 EUR/USD

buy 150 EUR/USD

buy 200 EUR/USD

a sell 1000 EUR/USD will result in multiple transaction tickets recording the fill:

sell 100 EUR/USD - to close the long 100 position above

sell 150 EUR/USD - to close the long 150 position above

sell 200 EUR/USD - to close the long 200 position above

sell 550 EUR/USD - to record the short 550 position

Immediately-Executed Orders: Market Orders, Limit/Stop Orders Requested FOK/IOC

A FIX market order entered with no TimeInForce <59> is submitted as an

OANDA BuyMarket or SellMarket request. Filled orders are recorded;

rejected orders do not result in any transaction ticket record.

A FIX order entered with TimeInForce <59> as 3 (immediate-or-cancel)

or 4 (fill-or-kill) which results in any fill will record a

BuyMarket or SellMarket transaction ticket; fully-canceled (no fill)

orders record a CancelledBuyMarket or CancelledSellMarket

transaction ticket. The price stipulation for limit and stop orders is

recorded in one of the the high_order_limit / low_order_limit

fields; market orders do not have any price stipulation.

| OANDA transaction ticket record | information recorded |

|---|---|

| price | market price at time of execution |

| units | number of units actually filled sum across the group represents the CumQty <14> |

| high_order_limit | records the price stipulation (the Price <44> for the limit order, the StopPx <99> for the stop order); only one order_limit is valid for any order |

| low_order_limit | See high_order_limit above |

| completion_code | records type of ticket: FOK, IOC, or standard |

| transaction_link | records the ticket number of any existing position countered by this ticket |

| order_link | not applicable |

| order_qty | the first transaction ticket of a group will record the OrderQty <38> |

| min_qty | the first transaction ticket of a group will record the MinQty <110> if provided, otherwise 0 |

Price-Conditional Long-Duration Orders

Limit, Stop, and Market-if-Touched orders entered with TimeInForce of DAY, GTD, or nothing (defaulting to DAY) result in a number of transaction tickets representing the outstanding order, and a number of tickets representing the fill if one occurs.

Of the tickets representing the outstanding order:

a new limit order creates a

BuyLimitorSellLimittransaction ticketa new stop order creates a

BuyStoporSellStoptransaction ticketa new market-if-touched order creates a

BuyEntryorSellEntrytransaction ticket- note this order is called a “limit order” on the GUI interface

any Order Cancel / Replace Request <G> results in a

ChangeOrdertransaction ticket recording the new order parametersany Order Cancel Request <F> results in a

CloseOrdertransaction ticket recording the cancelation of the orderany order trigger results in a

CloseOrdertransaction ticket recording the triggering of the orderany order expiry results in a

CloseOrdertransaction ticket recording the expiry of the order

| OANDA transaction ticket record | information recorded |

|---|---|

| order creation ticket | |

| units | records the initial requested OrderQty <38> |

| time | time of order entry |

| price | records the price stipulation (Price <44> or StopPx <99>) |

| duration | records the expiry time of the order |

ChangeOrder ticket |

|

| units | records updated OrderQty <38> |

| time | time of order modification |

| price | records updated price stipulation |

| duration | records updated expiry time |

| transaction_link | records the order this modification ticket pertains to |

CloseOrder ticket |

|

| completion_code | records type of close: cancel, expiry, or fill |

| transaction_link | records the order this closing ticket pertains to |

If a fill occurred, a group of transaction tickets will record the units resulting from the fill. Similar to immediate-execution orders described above, any existing opposite-position tickets will have a ticket to close that position, and the net position is recorded in the last transaction ticket.

| OANDA transaction ticket record | information recorded |

|---|---|

| price | price of fill; the value represents the LastPx <31> |

| units | number of units actually filled sum across the group represents the CumQty <14> |

| high_order_limit | not applicable |

| low_order_limit | not applicable |

| completion_code | |

| transaction_link | records the ticket number of any existing position countered by this ticket |

| order_link | records the ticket number of the order entry that this fill amount is a result of |

The diaspora record cannot be relied on to group position tickets resulting from one action together. Please consult the execution reported list of ticket numbers instead.

Trades/Orders limitation

Although FIX API users interact with the system using the FIX order model and see the FIX view of orders, the user’s account is hosted on the OANDA system and as such is still subject to account- and user-based limitations.

Each account is limited to 1000 OANDA trades maximum, as well as 1000 OANDA orders maximum. Customers who build up a net position with a large number of small-unit trades may find themself up against the 1000-trade limit.

Requests that would result in exceeding either the trade or order limit are rejected with Text “Maximum number of open orders or trades exceeded”. FIX orders (limit, stop, market-if-touched) that trigger but would result in exceeding the 1000-trades limit are canceled with the same Text annotation.

Currently the only way to view open trades and open orders is via the graphical user interface or via the Open API.

Prime Brokerage Customers

Institutional customers wishing to trade on the OANDA system and hold positions at their own account with a prime broker will see different behavior. Specifically:

positions are moved to their account at the prime broker and as such the user would not encounter the 1000-trade limit

prime broker customers do not have funds on deposit and are not subject to margin checking; trades will not fail due to insufficient funds

market data served to prime broker customers will have an additional field SettlDate <64> reporting the current value date for trades on the symbol